State of the deep tech entrepreneurship in the UK and the emerging trends by Natalya Vilyavina

The Present State and Emerging Trends of Deep Tech Entrepreneurship in the UK

Hello! I am Natalia Vina - a venture manager and AI stream lead at the Creative Distraction Lab at the University of Oxford. Today, I will explore the state of deep tech entrepreneurship in the UK, focusing on the emerging trends we're witnessing.

Understanding Deep Tech

Deep tech, fundamentally, is technology that emerges from scientific discovery. Its commercialization and application fields are still burgeoning. Deep tech is not merely an application of existing technology. It's not a simple software or built on pre-existing digital infrastructure.

Deep tech is distinguishable by the following aspects:

- High Risk: Besides the customary market risk, it's also subjected to commercialization and R&D risks.

- Commercialization Strategy: Oftentimes, we see research conducted and technology developed without a clear commercial strategy. The technology comes first, while the commercial strategy is yet to be determined, increasing the risk factor.

- IP-dependent: Around 70% of the deep tech enterprises we observe have their IP and have safeguarded it.

- Intersecting Technologies: Nearly 90% of companies use a blend of technologies. For instance, a combination of AI and biology or AI and Material Science.

- Requires Patient Capital: The capital needed for deep tech development demands patience as all the technologies can be time-consuming.

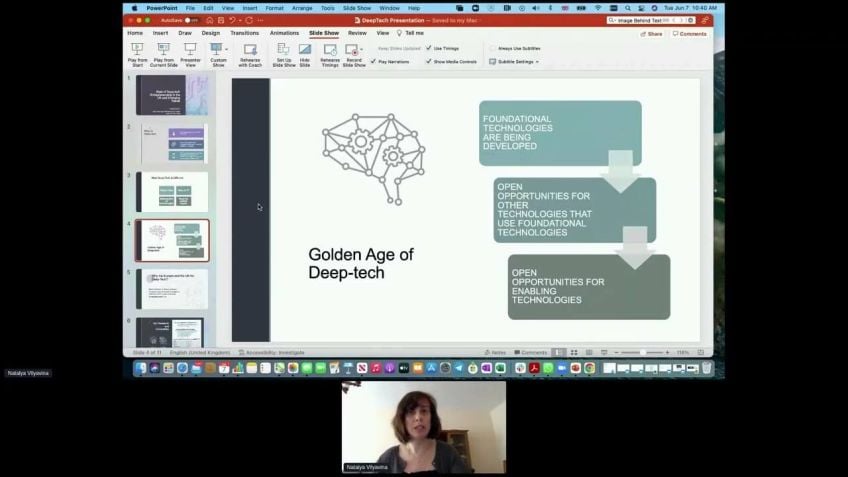

The Present Golden Age of Deep Tech

Currently, we are arguably in the golden age of deep tech. Multiple foundational technologies such as AI, quantum technology, and CRISPR are being developed, forming the basis for novel technologies. For instance, AI has reduced the cost of prediction, thereby creating an environment conducive for the birth of other technologies based on this foundational technology.

Deep Tech In Europe and the UK

Deep tech has seen substantial growth in Europe and the UK. For instance, a quarter of European VC funds go to deep tech. Additionally, in 2020, the UK's deep tech investment was 17% up – making it the highest global growth rate. A significant share of highly-cited research publications (around 43%) can be attributed to the UK and Europe.

The map of spin-outs from the University of Oxford portrays the growth of deep tech startups. It indicates an upward trend, suggesting deep tech will continue to grow and garner interest within the VC community.

Emerging Trends In Deep Tech Entrepreneurship In Europe

Deep tech investments in Europe doubled in just the first nine months of 2021, demonstrating an upward trend. The areas of quantum computing, Digital Twins, AI for drug discovery, and neurotechnology see considerable investments.

Moreover, an emergent trend of ‘Deep Tech for Good’ has surfaced. Areas like battery technology, carbon capture, hydrogen energy, waste-to-energy, and long-duration energy storage have seen an increase in investments.

The Deep Tech Gender Gap

Unfortunately, the deep tech landscape is not immune to gender bias. Only 15% of deep tech startups are founded or co-founded by women. Gender bias presents itself in two dominant forms – the general belief women are inadequate for business and that women are unfit for deep tech.

However, the accomplishments of successful female scientists such as Marie Curie, Sarah Gilbert, Emmanuelle Charpentier, and Jennifer Doudna demonstrate the capability and competence of women in the deep tech sector. The industry must strive to recognise this, overcome the bias, and provide equal opportunities to all.

If you're intrigued by all that profound tech has to offer or if you're a visionary investor seeking to explore emerging trends in innovation, stay tuned with us!

Video Transcription

My topic today is the state of deep tech entrepreneurship in the UK and merging trends. My name is Natalia Vina. I'm a venture manager and A I stream lead at Creative Distraction Lab at the University of Oxford Creative Distraction Lab.For those of you who don't know is a deep tech uh program for uh start ups. Um uh It started at the University of Toronto in 2012 and since then, it's grew to 11 sites globally. And our aim is to help founders uh commercialize the deep tech and um uh create uh um uh uh increase the probabilities of success for a deep tech founders. So, first of all, let's think about like what, what is deep tech let's have, have some definitions. So deep tech is a technology based on scientific discovery. This is new technology which commercialization um uh application are just being developed and what deep tech is not deep tech is not an application of existing technology. This is um um not a new piece of software or an N built for pre existing uh digital infrastructure. So, uh how deep tech is different? Uh So, first of all, deep tech is a higher, high risk. And um uh in addition to um uh usual market risk, there is a risk of commercialization R and D risks.

Uh And um uh I just um uh so, iii I in, in the deep tech, what we usually have is the um um uh uh commercialization usually comes uh in, in, in a normal start up. You would go with the, you will start with why, why we are creating start up? Because there is a um a problem that we want to solve in a deep sometimes it comes in a different way. So sometimes we, we see that there is research being done, interesting technology being developed. But the commercialization strategy is not really clear and this is why uh it's, it's, it's usually, it's often we can see that um in a deep tech you uh come with the um first you have the already the technology and then you need to figure out what the commercial strategy for it.

This is why it's even more risky. And the venture VCFV CS are often very um um aware of it uh because they have to take higher risk. And sometimes we have found that they come to us that created destruction lab. And they can say, for instance, we uh our technology is um a broad technology that can apply to different areas. We developed it in the lab. It's like a calculator, it can do multiplication division. Um um um subtraction. Uh And what we always tell them is that first year technology needs to be a product and then a platform. So you cannot start from the platform from a broad technology. You first need to find your unique use case and apply it to um other uh to, to different verticals. What is also uh very common for deep tch, it's always rely on IP. Um Usually, it relies on A P and about 70% of the companies that we see um have um uh uh have developed their own A P and have secured this A P. Um Another uh differentiation of the tech is usually it comes in the intersection of technologies. So for example, um it can be uh A I and uh biology, A I and Material science. Uh And about 90/90 percent of the companies um don't use like just one technology in deep tch, they use a combination of technology.

And finally, uh the other differentiation of the tech is that it requires patient capital. Um It means that uh the um uh the capital for uh deep tech is development of the deep tech requires a lot of time. So the first time, the first phase is R and D phase, which is can be many years, especially for like drug discovery when you can clear different regulatory hurdles. Uh And uh that's why it's also very common for, for deep tech start ups to first have first money usually come from um grants and government funding and these kind of things. Um OK, let's move on and talk about um why um deep, why it's golden age of deep tech right now. Um I believe it is uh because a lot of foundational technologies are being developed and by foundational technologies, I mean, technologies such as A I or quantum or CRISPR technology which is create um basis for other technologies that are being developed. So for example, um if you um in, in, in, in um in CD L for instance, we say that um um your technology needs to do something better, faster or cheaper. And uh technologies like artificial intelligence or quantum computing, they do make things better, faster and cheaper.

For example, um founder of create distraction lab AJ Edgar Wal, he wrote a book that is called um Prediction Machine where they argue that um A I makes cost of prediction cheaper and by making cost of prediction cheaper, you can create other technologies based on uh um um be because the cost of prediction becomes cheaper.

The other technologies can be developed based on this foundational technology which is artificial intelligence. And same things for uh quantum computing, quantum computing makes the um uh compu computational um computation faster and more efficient. And therefore all the technologies can be developed based on this foundational technology.

So this is like one thing uh so that these foundational technologies in deep tech, create opportunities for other technologies that you use them as a basis. Also foundational technologies uh create opportunities for enabling technologies. So what it means is um for example, if we take uh quantum computing and in quantum age, every every task can be done really, really quickly. Um what it means. It means that for instance, the um uh the uh cybersecurity um security in quantum age is really vulnerable because all our passwords are by default can be really quickly solved by uh quantum computers. So we need to rethink and start ups have to rethink uh what is the security and quantum age look like and develop respective technology. So therefore, this foundational technologies, they both create the background for new technologies to be developed but but also they al they create the, the um they enable technologies that facilitate these technologies to be used. So the next, the next part of my presentation is about Europe and the UK. So why deep tech in Europe and in the UK? So first of all, quarter of European VC funds uh uh go to deep tech.

So the quarter of the money go to deep tech, there was research that UK deep tech investment was uh 17% up in 2020 this was the highest growth rate globally. And this is also um um due to um high rate of top educational institutions in the UK and Europe. And let's look at the next slide and see what exactly in the top research in universities are happening in Europe. So first of all, high share of highly cited research publication, about 43% go to UK and Europe. Um uh European students are more likely to do STEM degrees as compared to the US peers. So you can see that in Germany, for instance, 35% of students are actually do stem uh in the UK, this is 26% and in the US, it's only 18. Also, you can see that uh in Europe um um uh universities that are on the top of the rank of the computer science. Uh It's out of 20 universities, seven universities are allocated in Europe and out of these 74 are actually in the UK. But if you see the size of um um of Europe and the UK, especially UK, you can see that you can actually um lifts much above its own weight.

So the um size of the size of it, of the economy and size of the country is not that big as the US for instance, but it, it has a lot of um um uh research and um um computer science um opportunities here. So next, I'd like to share with you. My apologies. This is my screen. Uh I'd like to share with you um uh the fact that um deep, deep tech investment and spin outs in the universities are growing exponentially. So this map is uh we will not read this map, but I just want to share you, share it with you so that you see uh this is a map of um Oxford University spinouts from 1920 59 to 2020 21 of the uh University Innovation, which is tech transfer office of the university, which is responsible for the spin out start ups.

And you can see that over the course of these years, the number of the spin out start-ups grow, grow really exponentially. Um uh There is a slight concern and trick here that uh UK UK and Europe in general traditionally didn't have um very favorable spin out policy for the um of the founders of the deep tech start ups. This means that in the US, it is traditional that um the university could take like 3 to 5% of the share uh like of the uh of the start up when, when it spun out of the university. Um in the UK, it sometimes in, in Oxford, for instance, it used to be like can be like 50% or, or maybe 60%. So in, in, in this scenario, it's really difficult for uh uh for the scientists who have developed some technology that can be commercialized to um have an incentive to actually move this technology forward. Especially this is relevant for the technologies that requires a lot of funding.

Uh Because the further you go down in the series A series A series B and uh you have to give up a lot of share of shares of your, of your company. And if you start with a relatively small number of shares, like let's say 40% then the next round of the, you get with a really small percentage because of the dilution of your own shares. And it makes it really hard for the um scientists and start up founders to be incentivized to continue building these technologies for a long period of time. Um Luckily, this policy is changing in the UK specifically and in Oxford uh specifically. Uh so, um I think now the um uh default rule is that University of Oxford is taking about like 20% for deep tech uh spin outs. Um uh which gives still gives a good incentive for founders to uh continue building. Uh In the next slide, I'd like to um talk about like European deep tech investment scene in general. Uh This is an atomic report and we can see that uh in um this is a report of like just nine months of 2021. Uh And it's uh uh you can see that um capital investment in the start ups in Europe in 2021 in the deep tech start ups in Europe, almost doubled in the, in just in the first nine months of 2021 from $9.4 billion to $18.8 billion.

Uh So we see that the trend is going up. So this means that deep tech technology will continue to develop and grow. It's a lot of interest in the uh VC community to um continue investment. And um in the deep tech, uh these two stars on the on the right is represents the average around of the funding. It says that um over 50 about 50% of the start ups in Deep tech received the uh uh funding of um uh less than 5 million. And in the, again, in 2021 it was only 12 deals that received more than $250 million in one round. Um which uh obviously, uh which is may be obvious because um it uh at the first, at first, um you, you V CV C money go to like small larger proportion, but a smaller amount of checks and uh further down the line, there are, there were less successful start ups and the follow on rounds are um getting larger, but the number of those rounds are getting quite small.

Um OK. Um uh So next, I'd like to um give you a quick overview of the emerging trends of the deep tech uh in Europe that we observe this data comes from um uh pitch book uh and also like atomic report. So at the first glance, if you see this slide, it looks like um by the number of deal count the largest, by far, the largest investment, uh largest investment money go to quantum computer computing, Digital Twins A I powered for drug discovery um neurotechnology. However, if you look at the this gray boxes at the bottom, you can see some areas like battery technology, carbon capture hydrogen energy waste to energy um uh long duration energy storage. Uh To me, it looks like this, this comprises a big chunk of the investment money in the in, in Europe. And I would call this a deep tag for good investment. So it looks like there is in trend being developed in um in not only in deep tech but also in investing deep tech for good. So I, I found it interesting and I, I wanted to share this with you as well. So finally, um um I'd like to quickly stop at the uh deep tech gender gap.

And uh here um we all know that um um there are very few percentage of money in the BC, go to female um L start ups and especially small amount go to um only female led start ups. So here is some stats for you. Only 15% of deep tech start ups are founded or co-founded by women and only 6% have all women founding teams for every £1 in venture capital in the UK. In general, female founded teams get less than one penny and all male founded teams get 8189 pennies and mixed gender teams. 10 P. Uh So again, you see, like, if at least like one co founder, it's only 11% pretty much of venture money that goes to uh teams who are at least like one female founder and to all female teams, it's only 1%. It's general for, for the, for the, for the VC money. Um At the same time, if you look at uh female start ups in the industry such as cosmetics, shoes, home Decor, fashion, flowers, wedding beauty, 22% of the money go to female teams. There is a lot of bias in the VC industry that women can do beauty but they cannot maybe do a deep tech um uh female only L teams comprise 28% of all A I companies, but get only 1.5% of funding, which is 53% of the dollar as well.

So this gives you an idea, an idea about where we stand with the um investment and gender bias in the deep tech investment. And it seems that um there are two biases here, like one is that in general, there are much less money go to female teams uh which basically translates into uh the language uh that VC say we, we, we don't think that females are really good and do business. But there is another bias as well, which says that it seems like female females are less likely to do um um deep tech science. And uh therefore, it's another buzz that basically overlaps with the first one. So it creates this really tricky environment for uh deep tech um founders. I also spoke to um teams at Creative Destruction Lab, female lab teams. And they often uh tell me that um when they lead the company is the chief executive officer, they often hear from the V CS that they need to hire a professional CEO. Uh So basically giving them this um idea that maybe they need to step down and maybe have a secondary role and start up, not really like, not, not, not uh a CEO role.

So this is also really hard uh for the female founders to um have um um energy and uh uh strengths to overcome this um um biases in the in and the perception. What also, I also think that in the um deep tech, why so little money goes to deep tech uh female founders uh because um I think that um VC don't recognize this pattern. So there is not enough um spin out companies founded by V CS that have uh founded by females that have become already successful. And also the the development cycle of deep tech is so on. Uh So um it's really hard for uh for VC to see the, the, the pattern that actually I know the, I know the female founder and I know the start up that worked. And I know, this can be successful. And as we all know, all the money in the VC, this is about uh rec uh pattern recognition. And uh um as soon as we teach venture capital industry to recognize the pattern and to see that female founders can be successful, the more money go into, into, into, into the um deep tech for female founders.

Um And then the second part is about the um op opportunity opportunity for women to actually do deep tag. I want to leave you with one slide here, which is the uh successful female scientist um in the past century. And you can see here the um Marie Curie uh who got the Nobel Prize for in 1903 for um um uh researching of radioactivity. You see the uh Sarah Gilbert uh who was the uh one of the researchers at the University of Oxford and the uh founder of uh Oxford Astrazeneca vaccine, uh successful um um um Emmanuel um uh Carp Carpenter if I pronounce it right. And Jennifer do, who also won the Nobel Prize in 2020 for um um um CRISPR technology gen editing technology. So you see all these female founders, female scientists uh that are actually there and female can do uh science and female can do um deep tch so I want to leave you with this and thank you for very much for your attention. Apologies for my not perfect use of technology. Uh And I wish you a really pleasant um and uh day today and uh I hope to see you at the helping platform. Thank you.